Paper Money - A US Real Estate Bubble Blog |

| Reading Rates: MBA Application Survey – December 03 2008 Posted: 03 Dec 2008 08:07 AM CST  The Mortgage Bankers Association (MBA) publishes the results of a weekly applications survey that covers roughly 50 percent of all residential mortgage originations and tracks the average interest rate for 30 year and 15 year fixed rate mortgages, 1 year ARMs as well as application volume for both purchase and refinance applications. The Mortgage Bankers Association (MBA) publishes the results of a weekly applications survey that covers roughly 50 percent of all residential mortgage originations and tracks the average interest rate for 30 year and 15 year fixed rate mortgages, 1 year ARMs as well as application volume for both purchase and refinance applications.The purchase application index has been highlighted as a particularly important data series as it very broadly captures the demand side of residential real estate for both new and existing home purchases. The latest data is showing that the average rate for a 30 year fixed rate mortgage decreased 52 basis points since last week to 5.47% while the purchase application volume jumped 38% and the refinance application volume increased a whopping 203.3% compared to last week's results. It's important to note that although the steady decline in rates has likely played a significant role in the large increases in refinance and purchase application volume, it's also altogether possible that the MBAA has some difficulty in seasonally adjusting their numbers around the November and December periods. As you can see on the charts below, November through January usually brings some erratic spikes to the volume indices but the cause, at least in some part, is likely the result of troubles seasonally adjusting a noisy weekly series during the holiday season and not an actual spontaneous doubling of refinance activity. As was noted last year, it's probably sensible to wait until February to draw a final conclusion. The following chart shows how the principle and interest cost and estimated annual income required to cover the PITI (using the 29% "rule of thumb") on a $400,000 loan has changed since November 2006.  The following chart shows the average interest rate for 30 year and 15 year fixed rate mortgages over the last number of weeks (click for larger version). The following chart shows the average interest rate for 30 year and 15 year fixed rate mortgages over the last number of weeks (click for larger version).  The following charts show the Purchase Index, Refinance Index and Market Composite Index since November 2006 (click for larger versions). The following charts show the Purchase Index, Refinance Index and Market Composite Index since November 2006 (click for larger versions).   |

| On The Stamp: Food Stamp Participation September 2008 Posted: 02 Dec 2008 04:19 PM CST  As a logical consequence of the prolonged economic downturn it appears that participation in the federal food stamp program is on the rise. As a logical consequence of the prolonged economic downturn it appears that participation in the federal food stamp program is on the rise.In fact, household participation has been climbing so steadily that it has surpassed the last peak set as a result of the immediate fallout following hurricane Katrina. The latest data released by the Department of Agriculture shows that, on a year-over-year basis, household participation has increased a whopping 17.11% while individual participation, as a ratio of the overall population, has increased 16.34%. September's numbers show a marked surge in program participation, likely resulting from the recent jump in total unemployment, driving the nominal benefit costs up 30.48% on a year-over-year basis to $3,365,077,075 for the month and $26,292,110,075 year to date. Looking at the last chart that plots the total unemployment rate (unemployment rate of all traditionally unemployed workers plus all marginally attached and part time workers) and the population adjusted individual program participation rate normalized since 2005, one can plainly see that program participation would be expected to continue its surge into October and likely beyond.    |

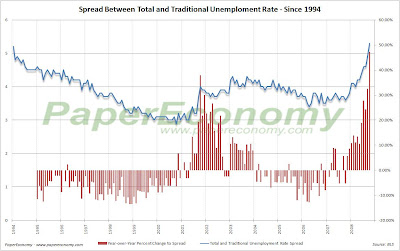

| On The Margin: Total Unemployment October 2008 Posted: 02 Dec 2008 10:14 AM CST  Today, I'm adding a new recurring post that will track the course of "total unemployment", i.e. the unemployment rate that includes all measures of employment underutilization. Today, I'm adding a new recurring post that will track the course of "total unemployment", i.e. the unemployment rate that includes all measures of employment underutilization.The traditional unemployment rate is calculated from the monthly household survey results using a fairly explicit qualification of "unemployed" (essentially unemployed and currently looking for full time employment) leaving many workers to be considered effectively "on the margin" either employed in part time work when full time is preferred or simply unemployed and no longer looking for work. The Bureau of Labor Statistics considers "marginally attached" workers (including discouraged workers) and persons who have settled for part time employment to be "underutilized" labor. The broadest view of unemployment would include both traditionally unemployed workers and all other underutilized workers. To calculate the "total" rate of unemployment we would simply use this larger group rather than the smaller and more restrictive "unemployed" group used in the traditional unemployment rate calculation. Below is a chart (click for larger version) showing the "total" unemployment rate versus the "traditional" unemployment rate along with the year-over-year percent change to the "total" unemployment rate.  Notice that the "total" unemployment rate has been skyrocketing as of late and has now with the latest 40% year-over-year increase has reached the highest level seen since the government began tracking the many measures of marginalized workers. Notice that the "total" unemployment rate has been skyrocketing as of late and has now with the latest 40% year-over-year increase has reached the highest level seen since the government began tracking the many measures of marginalized workers.The chart below (click for larger) calculates the spread between the "total" unemployment rate and the "traditional" unemployment rate.  Notice that while the total unemployment rate has increased 40% since last year, the difference between the total unemployment rate and the traditional rate has jumped nearly 50%, its highest annual increase on record leaving the spread at its widest on record. Notice that while the total unemployment rate has increased 40% since last year, the difference between the total unemployment rate and the traditional rate has jumped nearly 50%, its highest annual increase on record leaving the spread at its widest on record. |

| You are subscribed to email updates from Paper Economy - A US Real Estate Bubble Blog To stop receiving these emails, you may unsubscribe now. | Email Delivery powered by FeedBurner |

| If you prefer to unsubscribe via postal mail, write to: Paper Economy - A US Real Estate Bubble Blog, c/o FeedBurner, 20 W Kinzie, 9th Floor, Chicago IL USA 60610 | |

No comments:

Post a Comment