Paper Money - A US Real Estate Bubble Blog |

| Commercial Cataclysm?: Moody’s/REAL Commercial Property Price Index October 2008 Posted: 12 Jan 2009 08:46 AM CST  The Moody's/REAL CPPI data series is produced by the MIT/CRE but is noted to be "complimentary" to their alternative transaction based index (TBI) as it is published monthly and is formulated from a completely different dataset supplied by Real Capital Analytics, Inc. The Moody's/REAL CPPI data series is produced by the MIT/CRE but is noted to be "complimentary" to their alternative transaction based index (TBI) as it is published monthly and is formulated from a completely different dataset supplied by Real Capital Analytics, Inc.The latest results reflecting national data for all property types settled through October strongly suggest that prices for commercial real estate have eroded significantly. Taken together, the MIT/CRE Commercial Property Index, S&P/GRA Commercial Real Estate Index and the Moody's/REAL CPPI all appear to be firmly indicating that the nation's commercial real estate markets are experiencing a significant decline.  |

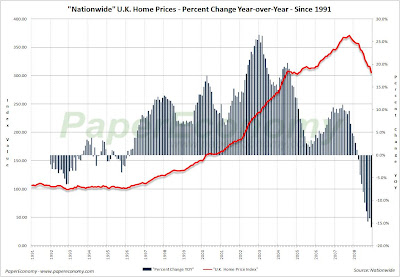

| U.S. Invasion: U.K. Home Prices December 2008 Posted: 12 Jan 2009 08:58 AM CST  The two most prominent and long running monthly U.K. housing price indices continue to register accelerating year-over-year declines resulting in the largest peak decline seen in at least 17 years. The two most prominent and long running monthly U.K. housing price indices continue to register accelerating year-over-year declines resulting in the largest peak decline seen in at least 17 years.The "Nationwide" series, which reported data through December, indicated that U.K. home prices declined 15.94% on a year-over-year basis while the "Halifax" series, which reported data through December, indicated that U.K. home prices declined 19.10% on a year-over-year basis. Both indices are similar to our own S&P/Case-Shiller data series in that they both implement a methodology that seeks to standardize the quality homes included as source data and track the price changes occurring between sales instead of simply tracking the distorted average or median sales price. The following charts (click for larger) show the price movement since 1991 to each index. Notice that annual price appreciation peaked in 2003 and continued to weaken consistently until early 2008 when it actually devolved into annual depreciation.   |

| You are subscribed to email updates from Paper Economy - A US Real Estate Bubble Blog To stop receiving these emails, you may unsubscribe now. | Email Delivery powered by FeedBurner |

| If you prefer to unsubscribe via postal mail, write to: Paper Economy - A US Real Estate Bubble Blog, c/o FeedBurner, 20 W Kinzie, 9th Floor, Chicago IL USA 60610 | |

No comments:

Post a Comment