Paper Money - A US Real Estate Bubble Blog |

| New Residential Construction Report: December 2008 Posted: 22 Jan 2009 09:55 AM CST  Today's New Residential Construction Report continues to firmly demonstrate the intensity and completeness of the washout conditions that now exist in the nation's housing markets particularly for new residential construction showing tremendous declines on both a peak and year-over-year basis to single family permits both nationally and across every region. Today's New Residential Construction Report continues to firmly demonstrate the intensity and completeness of the washout conditions that now exist in the nation's housing markets particularly for new residential construction showing tremendous declines on both a peak and year-over-year basis to single family permits both nationally and across every region.It's important to note that today's results strongly indicate that a new leg in the housing decline was reached between October and December with permit activity falling at the most significant rate seen in this decline. Single family housing permits, the most leading of indicators, again suggests extensive weakness in future construction activity dropping 49.2% nationally as compared to December 2007 and an astonishing 77.50% since the peak in January 2005. Moreover, every region showed significant double digit declines to permits with the Northeast declining 43.7%, the Midwest declining 49.1%, the South declining 49.7%, and the West declining a stunning 50.3% on a year-over-year basis. Keep in mind that these declines are coming on the back of last year's record declines. To illustrate the extent to which permits and starts have declined, I have created the following charts (click for larger versions) that show the percentage changes of the current values on a year-over-year basis as well as compared to the peak year of 2004. Declines to single family permits have contracted measurably in terms of monthly YOY declines, and the fact that we are now seeing declines of roughly 30%-50% on the back of 2006 and 2007 declines should provide a an unequivocal indication that the housing markets are by no means stabilizing.     Here are the seasonally adjusted statistics outlined in today's report: Here are the seasonally adjusted statistics outlined in today's report:Housing Permits Nationally

Nationally

Nationally

Keep in mind that this particular report does NOT factor in the cancellations that have been widely reported to be occurring in new construction. |

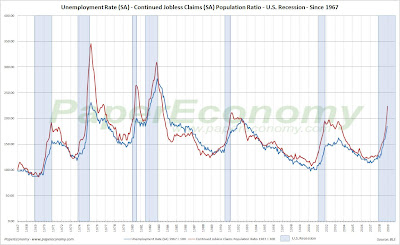

| Mid-Cycle Meltdown?: Jobless Claims January 22 2009 Posted: 22 Jan 2009 09:21 AM CST  Today, the Department of Labor released their latest read of Joblessness showing seasonally adjusted "initial" unemployment claims increased 62,000 to 589,000 from last week's revised 527,000 claims while "continued" claims increased 97,000 resulting in an "insured" unemployment rate of 3.4%. Today, the Department of Labor released their latest read of Joblessness showing seasonally adjusted "initial" unemployment claims increased 62,000 to 589,000 from last week's revised 527,000 claims while "continued" claims increased 97,000 resulting in an "insured" unemployment rate of 3.4%.It's important to note that although the last several reports have indicated a slight decrease in the seasonally adjusted initial jobless claims, the non-seasonally adjusted numbers are showing very large increases. The following chart shows the recent trend in initial non-seasonally adjusted initial jobless claims with the year-over-year percent change acting as a rough equivalent of a seasonally adjustment.  Historically, unemployment claims both "initial" and "continued" (ongoing claims) are a good leading indicator of the unemployment rate and inevitably the overall state of the economy. Historically, unemployment claims both "initial" and "continued" (ongoing claims) are a good leading indicator of the unemployment rate and inevitably the overall state of the economy.I have added a chart to the lineup which shows "population adjusted" continued claims (ratio of unemployment claims to the non-institutional population) and the unemployment rate since 1967. Adjusting for the general increase in population tames the continued claims spike down a bit but as you can see, the pattern is still indicating that recession has arrived.  The following chart (click for larger version) shows "initial" and "continued" claims, averaged monthly, overlaid with U.S. recessions since 1967 and from 2000. The following chart (click for larger version) shows "initial" and "continued" claims, averaged monthly, overlaid with U.S. recessions since 1967 and from 2000.NOTE: The charts below plot a "monthly" average NOT a 4 week moving average so the latest monthly results should be considered preliminary until the complete monthly results are settled by the fourth week of each following month. As you can see, acceleration to claims generally precedes recessions.   Also, acceleration and deceleration of unemployment claims has generally preceded comparable movements to the unemployment rate by 3 – 8 months (click for larger version). Also, acceleration and deceleration of unemployment claims has generally preceded comparable movements to the unemployment rate by 3 – 8 months (click for larger version).  In the above charts you can see, especially for the last three post-recession periods, that there has generally been a steep decline in unemployment claims and the unemployment rate followed by a "flattening" period of employment and subsequently followed by even further declines to unemployment as growth accelerated. In the above charts you can see, especially for the last three post-recession periods, that there has generally been a steep decline in unemployment claims and the unemployment rate followed by a "flattening" period of employment and subsequently followed by even further declines to unemployment as growth accelerated.This flattening period demarks the "mid-cycle slowdown" where for various reasons growth has generally slowed but then resumed with even stronger growth. Until late 2007, one could make the case (as Fed chief Ben Bernanke surly did) that we were again experiencing simply a mid-cycle slowdown but now those hopes are long gone. Adding a little more data shows that in the early 2000s we experienced a period of economic growth unlike the past several post-recession periods. Look at the following chart (click for larger version) showing "initial" and "continued" unemployment claims, the ratio of non-farm payrolls to non-institutional population and single family building permits since 1967.  The most notable feature of the post-"dot com" recession era that is, unlike other recent post-recession eras, job growth has been very weak, not succeeding to reach trend growth as had minimally accomplished in the past. The most notable feature of the post-"dot com" recession era that is, unlike other recent post-recession eras, job growth has been very weak, not succeeding to reach trend growth as had minimally accomplished in the past.Another feature is that housing was apparently buffeted by the response to the last recession, preventing it from fully correcting thus postponing the full and far more severe downturn to today. It is now completely clear that the potential "mid-cycle" slowdown that appeared to be shaping up in late 2007, had been traded for a less severe downturn in the aftermath of the "dot-com" recession, and now has we have fully entered, instead, a mid-cycle meltdown. |

| Homebuilder Blues: NAHB/Wells Fargo Home Builder Ratings January 2009 Posted: 21 Jan 2009 02:21 PM CST  Today, the National Association of Home Builders (NAHB) released their latest Housing Market Index (HMI) showing dramatic new lows and continued evidence that the new home market is experiencing a prolonged bout of depression. Today, the National Association of Home Builders (NAHB) released their latest Housing Market Index (HMI) showing dramatic new lows and continued evidence that the new home market is experiencing a prolonged bout of depression.Each component of the NAHB housing market index remain WELL BELOW the worst levels ever seen in the over 20 years the data has been being compiled strongly suggesting that the current severe contraction has surpassed all other events seen in the last 22 years and is now firmly in uncharted territory.     |

| Prime Bomb! : Hudson City Bancorp Prime Delinquencies Q4 2008 Posted: 21 Jan 2009 11:37 AM CST  I've been arguing for the better part of two years that although the traditional media and apparently general consensus has focused on subprime and other "toxic" mortgage products as the source for the credit tumult, the historic deterioration would by no means be limited to these "bleeding edge" products. I've been arguing for the better part of two years that although the traditional media and apparently general consensus has focused on subprime and other "toxic" mortgage products as the source for the credit tumult, the historic deterioration would by no means be limited to these "bleeding edge" products.Before this massive housing and general economic contraction is complete, I expect to see new records set for prime defaults, be they prime-Jumbo ARM loans, prime-Jumbo fixed rate loans, prime-conforming ARM loans or prime-conforming fixed rate loans… we will see historic defaults across the entire spectrum of mortgage products. Although there is significant debate about the true drivers of mortgage default, most individuals in default cite unemployment as the cause while other key instigators are: risky or insufficient household financial planning (high consumer debt and low/no savings), low-equity stake and housing depreciation, and simply general recession. The key point to consider though is that while all of these factors have contributed to creating environments of high mortgage default in the past, our current circumstances make these past periods look like walks in the park. In an effort to prove out this conjecture, I will track, with a quarterly recurring post, the operating performance of one of today's most celebrated "conservative" mortgage portfolio lenders, Hudson City Bancorp (NYSE:HCBK), to see how their borrowers perform over the course of this economic downturn. Hudson City is now fully recognized as the "poster child" for safe prime-only mortgage lending, stringent underwriting standards and a CEO, Ronald Hermance, whose frequent media appearances usually come with heaping portions of high praise and accolades. It's important to understand that although Hudson City's average borrower has a reasonable LTV of 61.5%, they are still seeing a precipitous increase in loan defaults. In fact, currently the average LTV of their non-performing loans (defaulted loans) is 69% so "prime" borrowers with 31% equity at the time of origination are now defaulting in steadily increasing numbers. The following chart plots Hudson City Bancorp's Non-Performing Loan Ratio (defaulted loans to total loan portfolio) since Q1 2004. Notice that defaults have been on the rise since Q2 2006 while in Q2 2007 things really started to heat up.   But how does the growth in defaults of the Hudson City Bancorp "prime" portfolio stack up compared to other well know default rates? But how does the growth in defaults of the Hudson City Bancorp "prime" portfolio stack up compared to other well know default rates?The Following charts compare the Hudson City default rate to that of Fannie Mae and the MBAA foreclosure rate. The top chart compares the normalized default rates since Q1 2004 while the lower two compare the same data since Q1 2007 in order to get a sense of the respective growth over these periods. It's important to keep in mind that although Hudson City is not experiencing the same ratio of defaults (Fannie Mae and the general MBAA rates are worse) the growth of prime defaults is comparable and, since Q1 2007, has even been substantially higher.    As for Hudson City loan loss provisions, as you can see from the following chart, the capital cushion is dwindling. As for Hudson City loan loss provisions, as you can see from the following chart, the capital cushion is dwindling. The key instigators in this growth of default is likely home price depreciation and unemployment both working together to bear down on "prime" homeowners as is shown by the following charts plotting the year-over-year percent change to the New York area S&P/Case-Shiller home price index against the Hudson City default ratio as well as the unemployment in New York and New Jersey since 2004. The key instigators in this growth of default is likely home price depreciation and unemployment both working together to bear down on "prime" homeowners as is shown by the following charts plotting the year-over-year percent change to the New York area S&P/Case-Shiller home price index against the Hudson City default ratio as well as the unemployment in New York and New Jersey since 2004.  I will continue to update this data in coming quarters in order to see how slumping home values and rising unemployment affect the performance of "prime" borrowers. I will continue to update this data in coming quarters in order to see how slumping home values and rising unemployment affect the performance of "prime" borrowers. |

| You are subscribed to email updates from Paper Economy - A US Real Estate Bubble Blog To stop receiving these emails, you may unsubscribe now. | Email Delivery powered by FeedBurner |

| If you prefer to unsubscribe via postal mail, write to: Paper Economy - A US Real Estate Bubble Blog, c/o FeedBurner, 20 W Kinzie, 9th Floor, Chicago IL USA 60610 | |

No comments:

Post a Comment